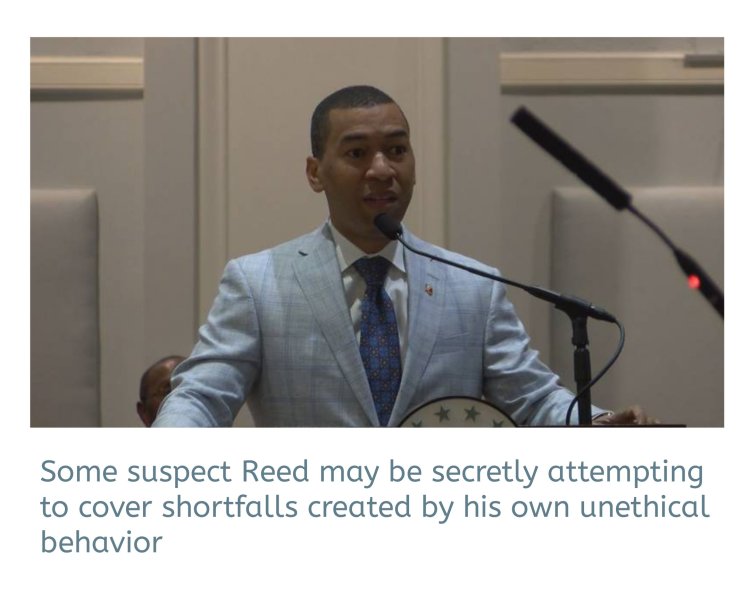

Mayor Reed and the Coming Healthcare Crisis Promising to Cripple City

{TheChronicle.cc} –Montgomery retirees are preparing to sue Reed administration for $55M… over $15 health-care copays

Retired Montgomery government workers are preparing to sue Mayor Steven Reed and the city for $55 million over $15 copays for doctors visits.

The Montgomery Civic Court class-action suit is to be filed on behalf of 930 retirees.

It claims the city and Colonial Life & Accident Insurance Company are violating a court order to not impose additional costs on retirees for the 20 percent supplemental coverage not covered by Medicare, the federal health program for senior citizens 65 and over.

Normally the City of Montgomery provides competitive benefit options for all full-time employees and their eligible dependents. These benefits include Core benefits offered by the City and Voluntary benefits through Colonial Life & Accident Insurance Company. Yet do to Mayor Reed's schemes and cost-cutting maneuvers, some responsibilities have fallen wayside.

The copays — which are far less than the standard $40-$50 fee required by private insurance — were imposed in January at the behest of Reed. Retirees previously were not charged a copay.

Early this year, Reed threw down the gauntlet. He forced the City Council to agree to allow his administration to switch retired city workers to a private Medicare Advantage plan — with an option to opt out in exchange for a high out-of-pocket price — or he would otherwise unilaterally move all retirees into a Medicare Advantage plan.

Retirees have argued that Medicare Advantage denies or provides less medical care than their current supplemental “Senior Care” plan.

“Copays are simply the city and Colonial Life’s poorly disguised way to pass along their costs,” charged Marianne Jenkins, spokesperson of the Montgomery Organization of Public Service Retirees, one of the plaintiffs.

“It violates the contract, the law, and the judge’s order and is outrageous. These copays are having a horrible impact on seniors who typically have to see several doctors every month.”

The plaintiffs are seeking $55 million in damages in the prepared lawsuit to be filed by Steve Bain of Birmingham's Avant Rose Cummings.

In the private sector, most employers do not offer retired workers health care. Private sector retirees have to rely on Medicare and personally cover additional benefits, TheChronicle.cc notes.

The lawsuit claims the $15 copays cause “irreparable harm” to retirees.

Medicare picks up 80 percent of the costs for hospital and doctor visits. Under an agreement with the unions, the city picks up the remaining 20 percent under the supplemental “Senior Care” supplemental plan.

“Imposing a $15 copay illegally transfers a portion of the 20% provider cost from the Defendants to Retirees. This seemingly minor fee is extremely onerous for elderly individuals living on small, fixed pensions who require frequent medical attention – and it is not permitted under the Contract,” Bain said. "I presume Reed knows this if he's mayor, and yet someone has convinced him that he can get away with it."

The prepared suit acknowledges the city spends “a great deal of money” — $1.5 billion on health insurance for active employees, retirees, and dependents in Fiscal Year 2023. About one-third of the cost covered retirees.

“Not surprisingly, the City has been looking for ways to save money on health insurance for many years,” the prepared suit says.

The suit accuses the city of breach of contract, unjust enrichment, fraudulent inducement, and false advertising.

A City Law Department spokesman said of the copay lawsuit, “We’ll review the case if they file. Hopefully we can come to some sort of accommodation and ultimately filing suit proves unnecessary. We have no other comment at this time.”

Colonial Life & Accident Insurance Company had no immediate comment on possible suit.

The prior administration under Mayor Todd Strange reached a deal with the unions that required retired firefighters, police officers, teachers, and other civil servants to enroll in the privately-run Medicare Advantage Plus plan to save the city $600 million a year.

Retirees would have to contribute $91 a month if they’d rather keep their current city-funded SeniorCare Plus Plan instead of enrolling in Medicare Advantage, but the courts have thus far blocked the change based on a prior lawsuit filed by retirees to prevent the switchover.

The Reed Administration and the city are still appealing that ruling.

Bad Seeds Secretly Planted By Steven Reed

In a controversial move December of last year, Mayor Reed vetoed an ordinance passed by the Montgomery City Council the previous week, directly impacting health insurance coverage for retirees. The ordinance, which passed by a narrow 5-4 margin and was sponsored by Councillor Glen Pruitt, aimed to halt changes to health insurance for retirees aged 65 and older without council approval.

Despite the council's decision, Mayor Reed vetoed the measure, sparking outrage among retirees and city officials alike. "Mayor Reed has vetoed the City Council's ordinance attempting to block AMWINS from taking over the City's contract to manage the City's supplemental health insurance program for retired Medicare-eligible employees. The Mayor's veto will save the City at least $6 million it would have owed providers for breach of contract and, according to the City Attorney, other potential legal exposure," a spokesman for the City of Montgomery justified.

City officials had previously announced in November that AMWINS Group Benefits, LLC, would assume administrative responsibility for the city’s supplemental health insurance program for retired Medicare-eligible employees beginning January 2024, replacing Blue Cross Blue Shield.

This change affects approximately 930 retired city employees over the age of 65, leading to widespread frustration. Montgomery City Councilman Glenn Pruitt reported receiving numerous complaints from retirees. "These people worked in the '60s and '70s for $400 and $500 a week. We have left them out of our budgets for many, many years," Pruitt said. "The one thing that they worked at the City of Montgomery for, we want to change on them. That's not fair. These people have worked. They have had it. They have done their duty, and now we're changing it on them."

A spokesman for the City of Montgomery explained in November that while Medicare remains the primary health insurance provider for retirees over 65, the change in January pertains to the third-party administrator for health claims not covered by Medicare. The city claimed that switching to AMWINS, offering similar benefits through United American Insurance at a lower monthly cost, was necessary to avoid increasing premiums for retired city employees.

However, Mayor Reed's decision to veto the council’s ordinance has been met with criticism for disregarding the concerns and well-being of the city’s retirees. By prioritizing potential cost savings over the needs of former employees, Reed’s actions have left many questioning his commitment to those who dedicated years of service to Montgomery.